closed end credit disclosures

E Mortgage loans - early disclosures - 1 Provision of disclosures - i Creditor. Permissible changes include the addition of the information permitted by 102617a1 and directly.

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Subpart B sections 10265 through 102616 relates to open-end credit.

. Permissible changes include the addition of the information permitted by 102617a1 and directly. 102637 Content of disclosures for certain mortgage transactions Loan Estimate. See the commentary to 10265 regarding conversion of closed-end to open-end credit 3.

If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion. For a closed-end transaction not subject to section 102619e and f determine whether the disclosures are accurately completed and include the following disclosures as applicable. Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements.

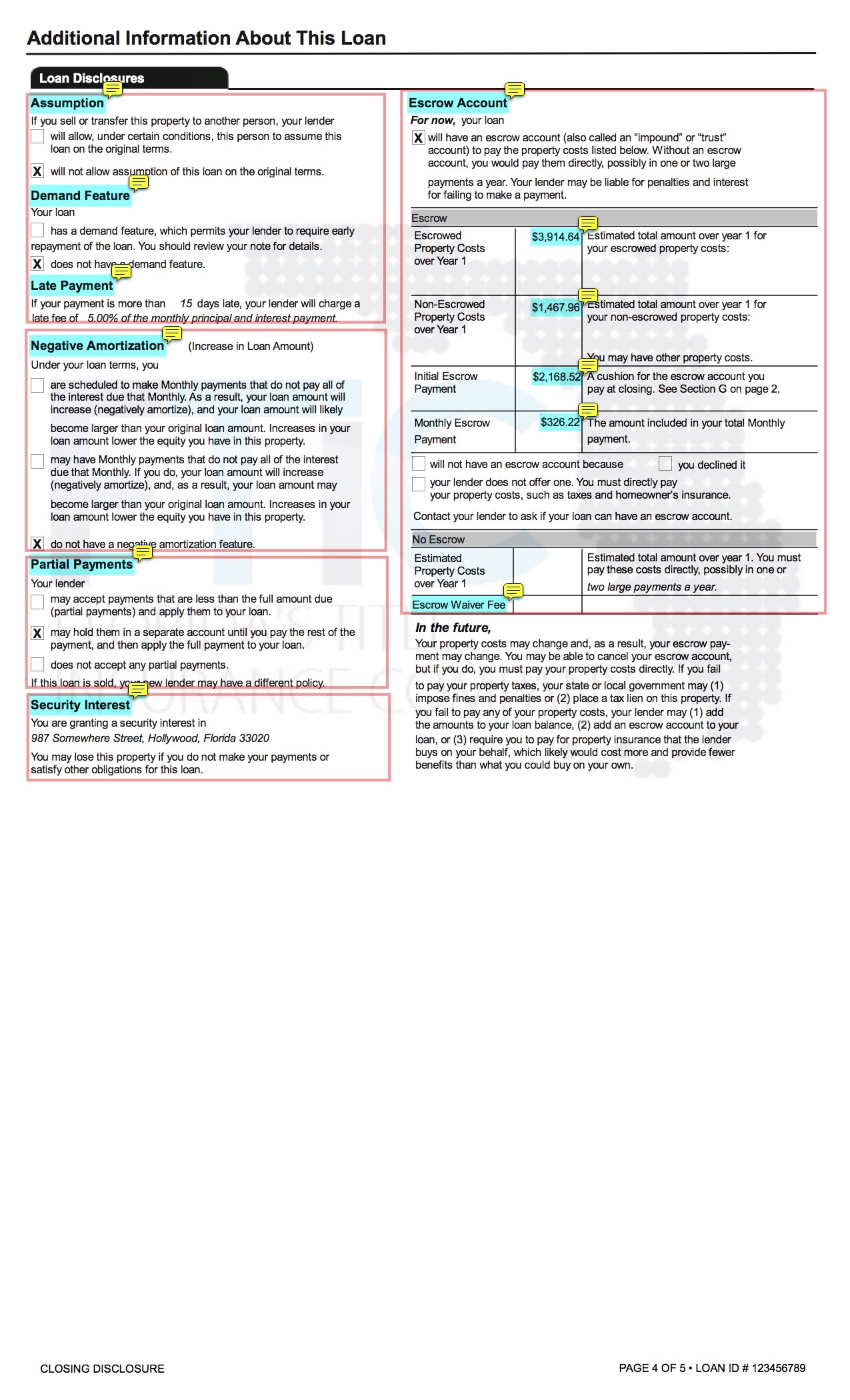

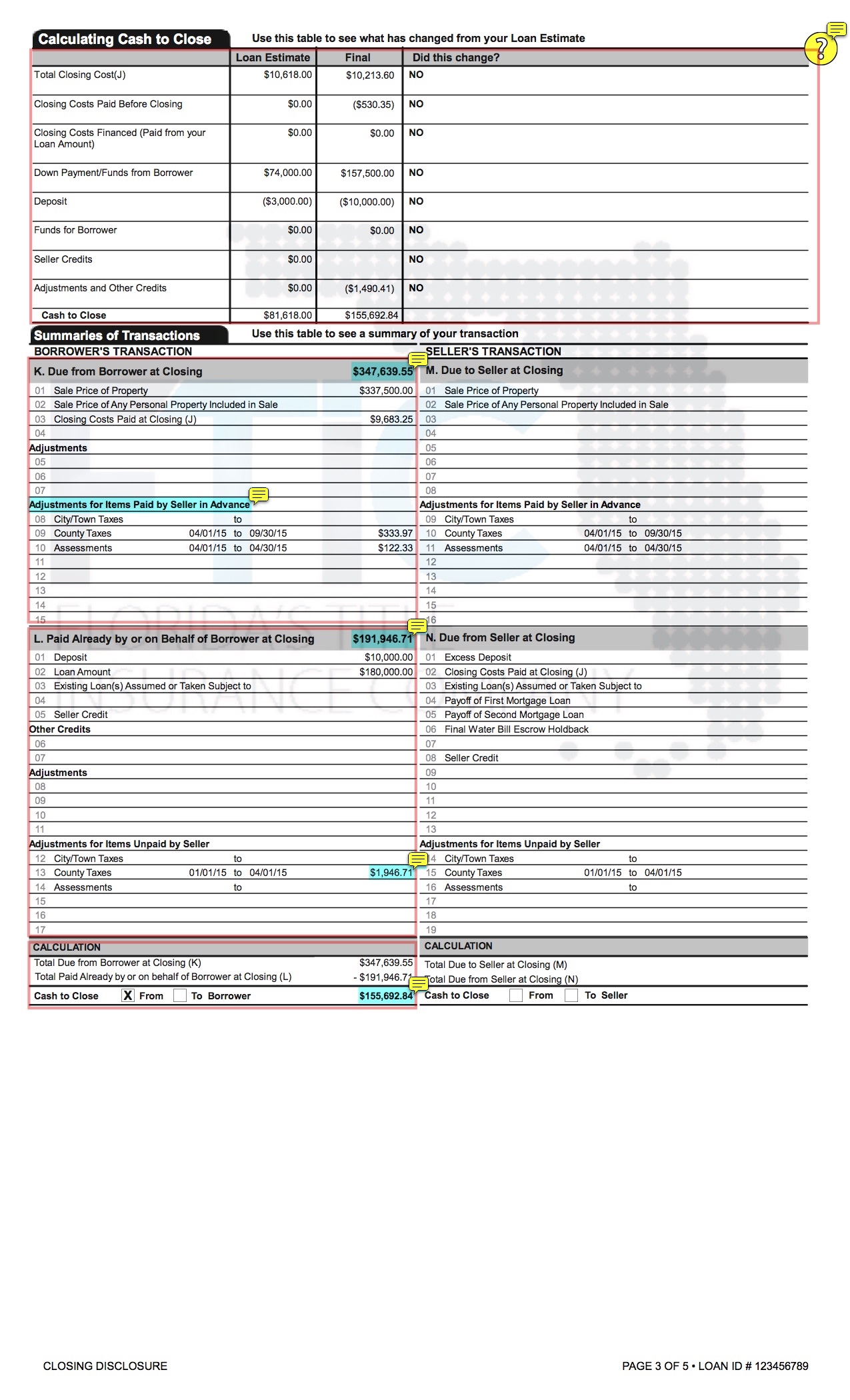

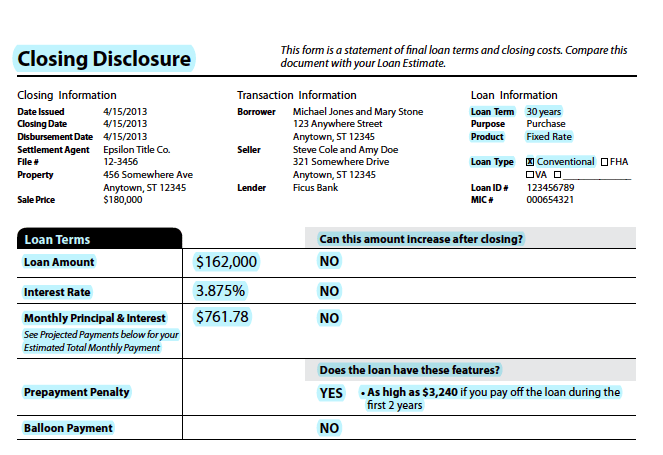

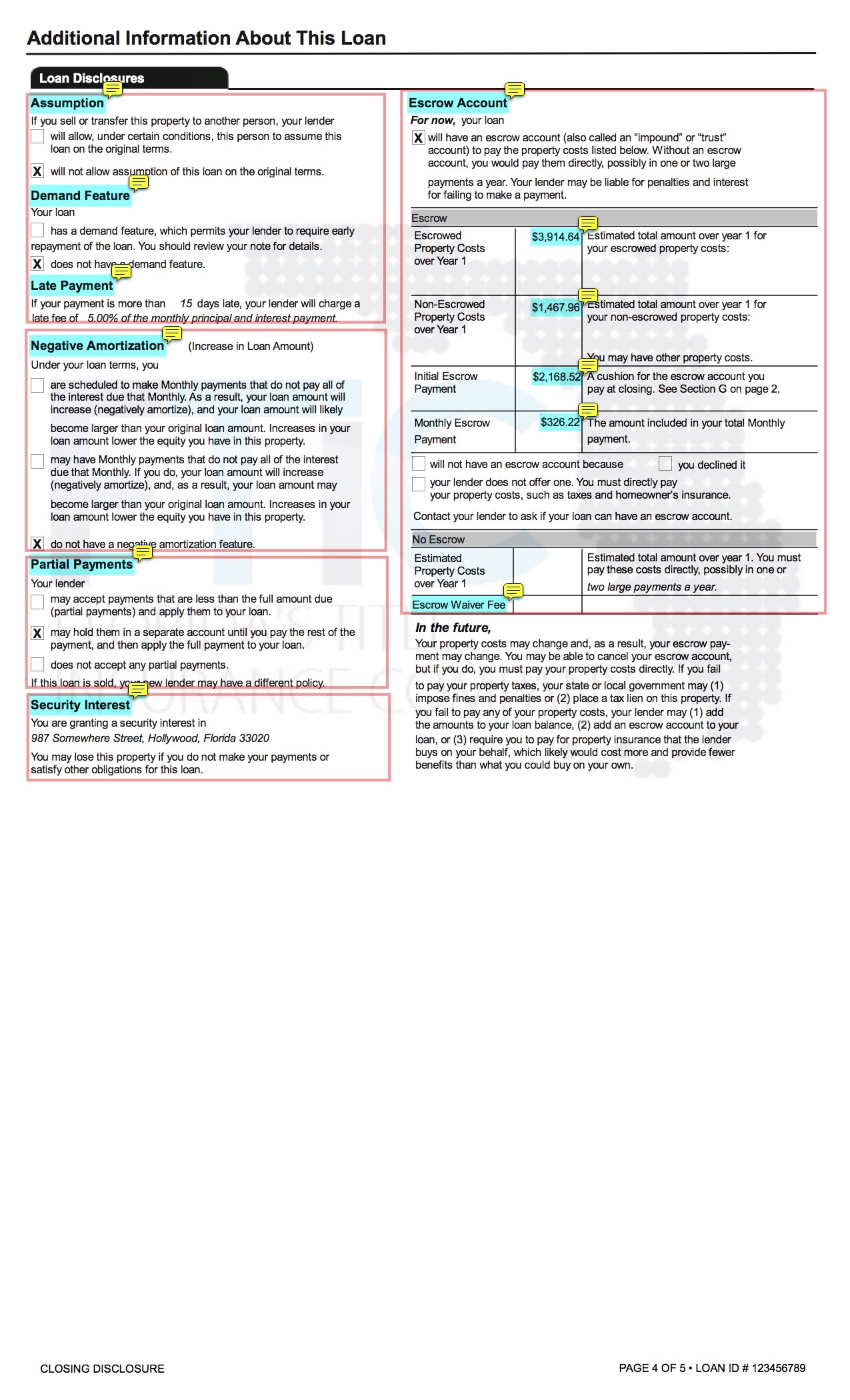

Closed-End Credit Disclosure Forms Transactions under 102619e f For a closed-end credit transaction subject to 102619e and f opens new window determine whether the credit union provides disclosures required under 102637 opens new window Loan Estimate and 102638 opens new window Closing Disclosure. If a closed-end credit transaction is converted to an open-end credit account under a written agreement with the consumer account-opening disclosures under 10266 must be given before the consumer becomes obligated on the open-end credit plan. Disclosures provided on credit contracts.

The disclosures required under subsection a with respect to any open end consumer credit plan which provides for any extension of credit which is secured by the consumers principal dwelling and the pamphlet required under subsection e shall be provided to any consumer at the time the creditor distributes an application to establish an. Identity of the creditor 102618a b. Accordingly the disclosures required by 102618 apply only to closed-end consumer credit transactions that are.

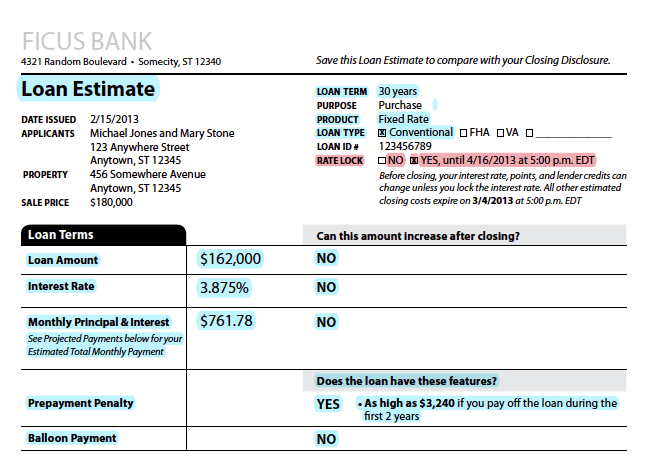

Identity of the creditor 102618a b. Creditors may make several types of changes to closed-end model forms H-1 credit sale and H-2 loan and still be deemed to be in compliance with the regulation provided that the required disclosures are made clearly and conspicuously. In a closed-end consumer credit transaction secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 the creditor shall provide the consumer with good faith estimates of the disclosures in 102637.

For a closed-end transaction not subject to sections 102619e and f determine whether the disclosures are accurately completed and include the following disclosures as applicable. 22619a1 and 22619a2 10. Using a vertical rather than a horizontal format for the boxes in the closed-end disclosures.

It sets forth definitions 10262 and stipulates which transactions are covered and which are exempt from the regulation 10263. Creditors may make several types of changes to closed-end model forms H-1 credit sale and H-2 loan and still be deemed to be in compliance with the regulation provided that the required disclosures are made clearly and conspicuously. Subpart C - Closed-End Credit 102617 102624 Show Hide 102617 General disclosure requirements.

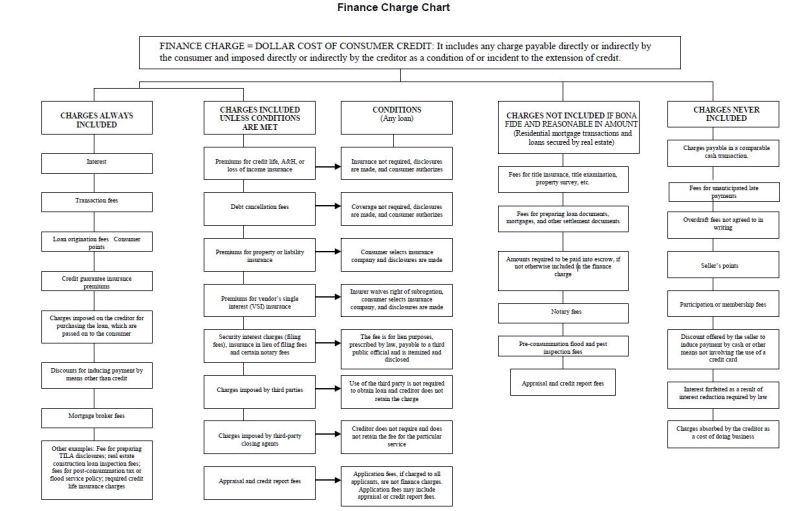

The main difference between open-end credit and closed-end credit is this. Closed-end credit is taken out once and has a specific repayment date. Students will learn the disclosure rules for annual percentage rate APR finance charge and amount financed including what costs are included.

For closed end dwelling-secured loans subject to RESPA does it appear early disclosures are delivered or mailed within three 3 business days after receiving the consumers written application and at least seven 7 business days before consummation. See the commentary to 102617 on converting open-end. Applies to open-end and closed-end credit transactions.

For closed end dwelling-secured loans subject to. In a closed-end consumer credit transaction secured by real property or a cooperative unit other than a reverse mortgage subject to 102633 the creditor shall provide the consumer with good faith estimates of the disclosures in 102637. Section 102619e and f applies to closed-end consumer credit transactions that are secured by real property or a cooperative unit other than reverse mortgages subject to 102633.

Intended for all lending personnel this course covers Regulation Zs key disclosure requirements for closed-end non-mortgage loans. The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for closed-end credit in a timely manner. 102619 Certain mortgage and variable-rate transactions.

Amount financed 102618b c. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure. 102618 Content of disclosures.

The Credit Union will provide the proper closed-end disclosures in the following manner. 2268 is the principal section for closed end credit disclosures. It also contains the rules for determining which fees are finance charges 10264.

Converting closed-end to open-end credit. Itemization of amount financed 102618c d. Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific requirements for credit sales for consumer loans for mail or telephone transactions etc.

Open-end credit like credit cards can be drawn from again and again and theres no fixed due date for paying the balance in full.

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Understanding Finance Charges For Closed End Credit

Mandatory Disclosures To Consumer

What To Know About The Loan Estimate Closing Disclosure Cd

Consumer Compliance Outlook Understanding Finance Charges For Closed End Credit Implementing The Consumer Compliance Rating System Nafcu

Truth In Lending Act Tila Consumer Rights Protections

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

New Mortgage Documents What Are They

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Federal Register Truth In Lending Regulation Z

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Appendix A To Part 1013 Model Forms Consumer Financial Protection Bureau

What To Know About The Loan Estimate Closing Disclosure Cd

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

/alta-sellers-closing-statement-26837264d4044785a5d0409dae83a510.jpg)